Bitcoin’s most recent gains come after it erased a year of losses and re-entered the $50,000 territory. This is significant because if Bitcoin can break through the psychological barrier again, then all bets are off as to what will happen next in this volatile market.

It shook up a narrow trading range and wiped away this year’s losses amid a broad rally for cryptocurrencies, sparking speculation that the biggest digital asset could advance past $50K soon.

A trading analyst said, “The $47,000 high on Monday is not a surprise at all and it was only the beginning of what we are going to see in 2022,” he added. By comparison, the S&P 500 has declined by 4.7% so far this year. Bitcoin, Ether, and altcoins like Solana’s SOL have also made significant gains, while altcoins like Avalanche’s AAVE and Dogecoin are up between 5.5% and 9.4%.

The next resistance level for Bitcoin may be $52,000, if it breaks through which it could rise to $65,000 – not far off the all-time high it reached in November, according to Fadi Aboualfa, Copper’s head of research. Bitcoin is “on the verge of a 20% run higher,” according to Rick Bensignor, president of Bensignor Investment Strategies.

Despite the Federal Reserve and other central banks having removed some of the stimulus measures implemented following the pandemic downturn, the coin has been stuck in a tight path. Consequently, there is less cash available for riskier assets, like cryptocurrency. A lot of analysts rebuffed the claim that digital currencies could be used to skirt Russian sanctions. Digital currencies also came under scrutiny because speculation swirled that they could be used to bypass Russian sanctions.

Even so, Bitcoin and other tokens such as Ether have been steadily rising this month alongside broader gains in U.S. stocks, but it took until the past day for Bitcoin to break through $45,000, a level that it had reached only briefly since early January.

According to Antoni Trenchev, managing partner and co-founder at Nexo, as we test the top of the 2022 trading range for the fifth time, it could be the next Bitcoin moment when the narrative changes and investors pile in, propelling the price higher. Bitcoin slumbering sideways since 2022 might be over.

U.S. Treasury Secretary Janet Yellen said in an interview with CNBC on March 25 that while she is skeptic about cryptocurrencies, “there are benefits and we recognize that innovation in the payment system is one of them.

The Luna Foundation Guard, an open-source initiative focused on the Terra blockchain, has also been rumored to be supporting trading with whale activity through its plans to back the network’s token with more than $10 billion in Bitcoin reserves.

Momentum trading

Bitcoin is now trading at $41,085, which is well above its 50-day moving average, placing it around the 80th to 90th percentile, according to Bespoke Investment Group. While that signals the possibility of a price drop for many assets, with Bitcoin historically it has been the opposite.

According to the Bespoke report, “it has averaged significant gains going out one to 12 months when it has been similarly overbought in the past.”

Based on Bespoke’s data, Bitcoin has historically gained 16% the next month when its spread was in the ninth decile, 100% six months later, and 274% after a year when it was in the ninth decile.

Bespoke writes, “This is not generally what you see for the typical stock or ETF, however, since Bitcoin has dominated the market over the years and has a lot of momentum trading in its favor, overbought levels have not yet become a concern for this particular space.”

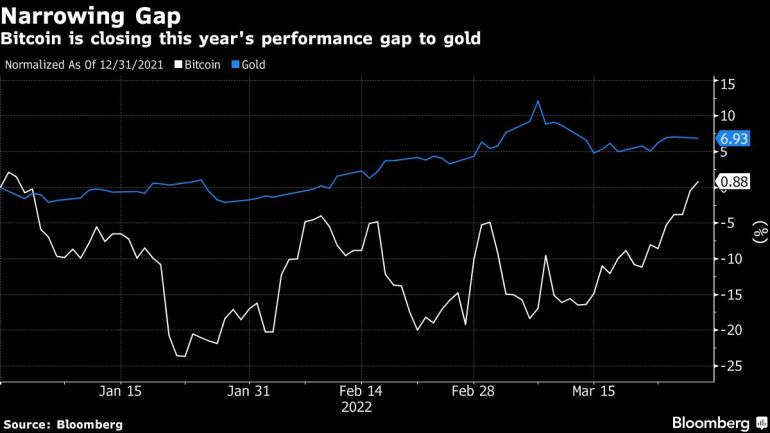

Despite Russia’s prolonged war in Ukraine, Bitcoin’s gains since mid-March also bolstered it versus gold, its traditional safe-haven rival, which traded sideways throughout the period.

Via this site.