The world of blockchain has been burgeoning with non-fungible token (NFT) games and collectibles. The crypto community has been witnessing cat, dog, and other animal-shaped NFTs flooding the market. But what is a dual-token? And how is it different from Genesis Tokens and Blind Box NFTs? This article aims to demystify these terminologies by exploring their core attributes and comparing their tokenomics so that you can get a fair idea about which category of NFTs suits your needs best at this moment.

In part two, we examine dual-token projects, which are the most popular model today for GameFi

Previous to this article, we discussed three tokenomic models for single-token blockchain games and their pros and cons.

Here, we will discuss dual-token projects, an innovation that followed single-token games, which are currently the most popular model.

As part of the dual-token model, Axie Infinity introduced SLP (Smooth Love Potion) in the first half of 2020 to ease selling pressure on AXS, the original game token.

The dual-token economy has been present in almost all major titles since then.

We should examine how Axie rolled out SLP in order to understand how dual-token games work and why they exist.

Prior to introducing SLP, Axie was a single-token GameFi, where players input USD and received the game token, AXS. Axie successfully ran on just one token for over a year thanks to enormous user growth and money from PE funds.

It was not hard for Axie to realize the importance of new users to the projects. Without new funding, the project would go into a death spiral.

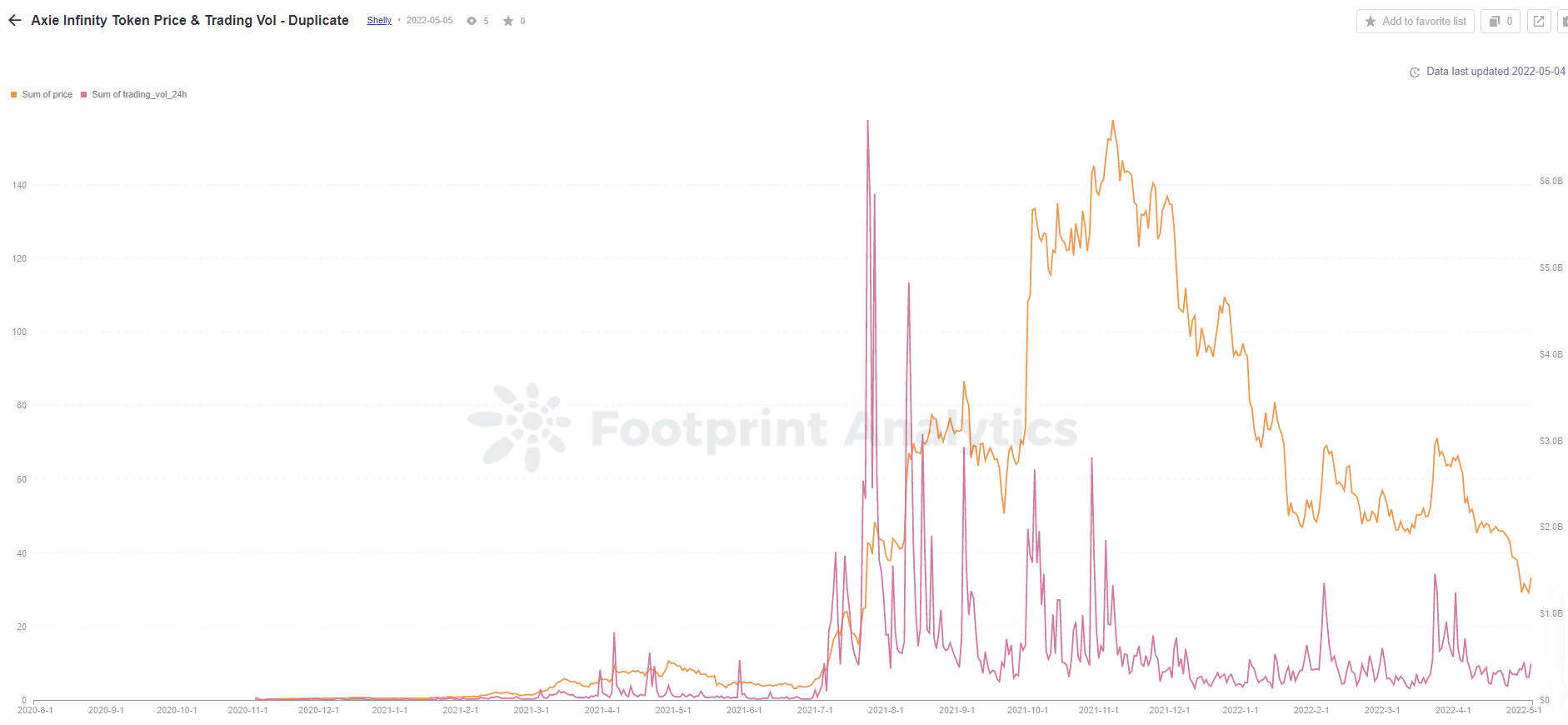

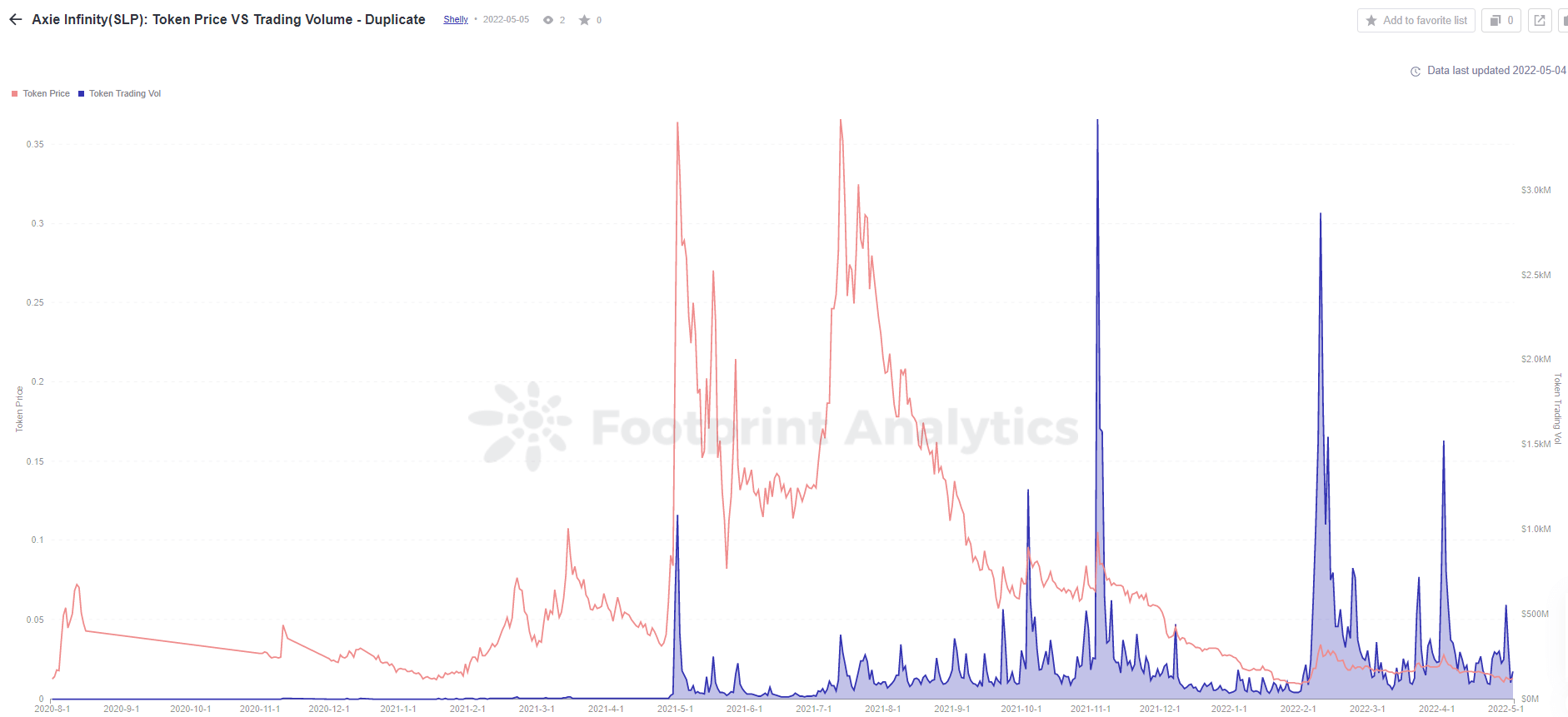

Axie introduced SLP in 2020 to ease selling pressure on AXS. SLP was an in-game utility token players could use to breed new Axies and to earn more SLP. AXS was used for governance and staking rewards. Development team increased breeding ratio and reproduction amount for $AXS-$SLP.

Initial results were as expected. Footprint Analytics reports that AXS’s price soared right after SLP was introduced, whereas SLP’s token price remained below $0.1 for several months. Since the summer GameFi, SLP has seen an increase in new users.

SLP, however, soon fell into a death spiral and this trend did not last long. Decentralized community governance was introduced by the Axie team in response. SLPs were also removed from the game’s PVE (Player vs. Environment) earnings on Feb. 9 in order to reduce SLP mint and supply. Because of these changes, SLPs became more expensive.

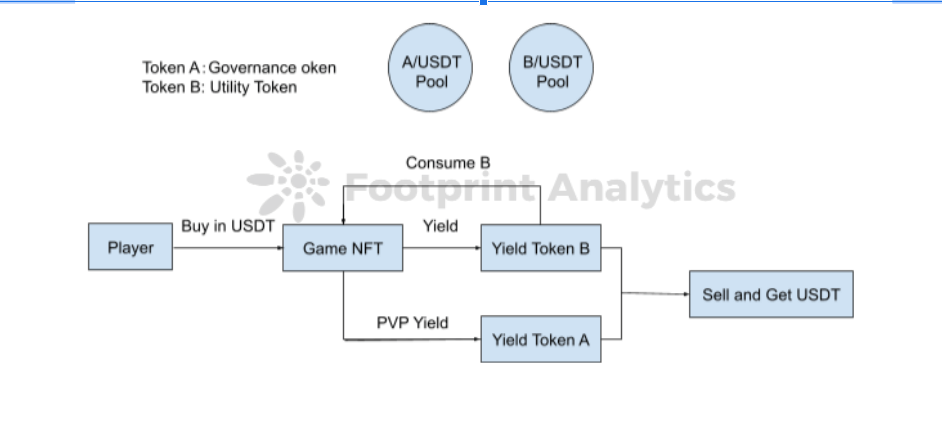

Currently, there is a dual-token model in which one token is mainly used for governance – owning more of these tokens will give the holder more voting power in community votes about the project – while the second token is used for in-game functions, e.g., the utility token. Players earn the majority of the yield in the utility coin, which is usually less valuable, and a small amount in the governance coin as a premium, for example, if they own valuable NFTs.

The dual-token model is also used by other popular GameFi projects, including BinaryX and Starsharks.

Two Different Categories of Dual Tokens GameFi

There are a number of newly released dual-token GameFi projects that use the “input game token and output game token” model.

BinaryX players start the game with governance tokens and yield utility tokens as returns, while Starshark players start the game with utility tokens and yield utility tokens as returns.

The previous article showed that this model’s token price is highly correlated with cost and returns. Tokenomic models can be adjusted without centralized adjustment with dual tokens much more easily than USD value-based models. USD-based models require an oracle to specify the number of corresponding tokens, complicating dual-token models.

An analytical approach to dividing different categories of dual tokens is provided in this article.

GameFi: After the Genesis NFT sale, what is the project owner’s approach to increase the number of NFTs on the market in order to meet the demand for NFTs from new players?

Most GameFi projects will first sell Genesis NFT on the official platform or through partners such as Binance NFT or Opensea to accumulate initial players. Then they can mint further NFTs and fuel token consumption. These include:

- Breeding Model: In this model, the second generation NFTs and subsequent NFTs come from the breeding of Genesis NFTs, with no more blind boxes sold. This mechanism requires burning/spending tokens to mint the new NFTs, which allows the game to influence the selling pressure on the tokens depending on the price of minting.

- Blind Box Model: Compared with the breeding model, the blind box is simple. The team sets the number of NFTs in the game, and when the market is good, or consumption goes up, players sell more. This buoys the price of the tokens because they need them to buy the NFTs.

However, all ambitious, long-term projects will declare that the majority of blind box sales proceeds – regardless of whether they are in USDT or utility tokens – go straight to the community treasury or are burned. Because StarSharks announced that it would burn 90% of utility tokens from blind box sales, it has become so popular.

In Conclusion

Among the most important metrics for a GameFi project are tokenomics, as well as metrics such as the number of new players, the number of active players, and the contrast between output and consumption. Throughout GameFi’s history, new economic models and innovations have emerged, each with their own pros and cons. Tokenomic models can also be used by serious investors to time bottoms, forecast FOMO inflation, generate yield during bottom stabilization, and other strategies.

Via this site.