Bitcoin and other cryptocurrencies have been on a wild ride all year. It’s safe to say that many experts agree that Bitcoin is in a bubble, but if it isn’t, it may be an asset whose value will continue to soar. But there are still questions about whether Bitcoin or other digital currencies will stay popular. Governments like China and India are cracking down on cryptocurrency trading because of the instability they bring to the economy.

The question on everyone’s mind is whether prices continue to rise in 2022.

Bitcoin Is A Bubble, And It’s About To Burst!

For cryptocurrency believers, Bitcoin is the ultimate store of value, the best safeguard against the inflation rampantly manufactured by reckless central banks and their money-printing. Skeptics view the crypto industry as a mirage whose massive rise past $2 trillion was simply a speculative reaction to the extraordinary amount of easy money that’s been floating about in the global economy — in effect, a big bubble.

There is about to be a big test for both of those theories.

As a bypass to Wall Street’s great calamity at the time, bitcoin emerged more than a decade ago out of the ashes of the global financial crisis. After gradually gaining a following, a rash of wannabes developed and the token went through some wild rides. Markets did not really take off until Covid-19, the next big crisis.

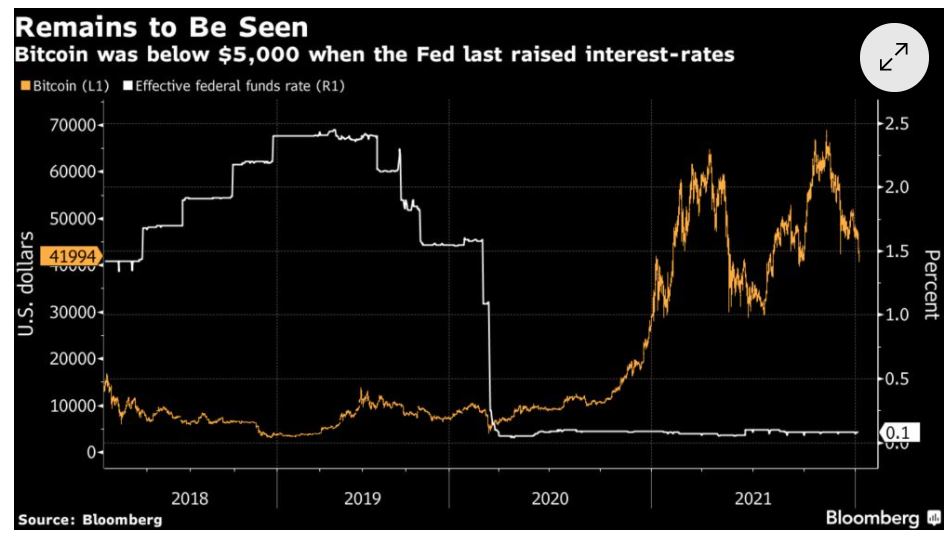

A trillion-dollar stimulus package was released by Congress and the Federal Reserve after March 2020 in response to the pandemic’s economic impact. A large portion of that money poured into digital assets, which inflated prices. By early November, Bitcoin reached a record price of almost $69,000, up 305% from the previous year. In the years since, however, it has suffered a relentless decline, a result in large part of the hawkish pivot of the central bank. It remains to be seen if the crypto ecosystem can hold up without it. Now that it is likely that policy makers will begin hiking rates in March — it remains to be seen if the crypto ecosystem can survive without liquidity – it’s just one of several steps they’re set to take to remove it.

In the short term, it doesn’t look good: Bitcoin has fallen 40 percent from its highs, while Ether, the No. 2 coin, and other “altcoins” have also fallen.

“If they’re going to hike rates three times in 2022 and keep the program, and the era of low rates is over, we’re going to really see how much people believed in their Bitcoin-crypto thesis,” FRNT Financial Inc. CEO Stephane Ouellette said. “I would expect that the Fed getting more and more hawkish is very bad for valuations.”

“The Federal Reserve’s seemingly perpetual asset purchases have been a cornerstone for crypto investing,” Michael O’Rourke, chief market strategist at JonesTrading, said.

The central bank should follow the path outlined in its latest minutes, which showed that officials may move faster than expected to increase interest rates and potentially shrink the bank’s balance sheet, then “that would immediately undermine the key bullish thesis behind Bitcoin and many other cryptos,” O’Rourke said.

Throughout Bitcoin’s 13-year history, its monetary policy has been easy and interest rates have been either zero or negative. It is true that there is no direct link between the Fed’s coffers and Bitcoin buy-orders on exchanges, but there is a connection, says David Tawil, president of ProChain Capital, a crypto hedge fund. One of the implications of the Fed purchasing any type of asset is that it can lift prices of other investments, as well. “All the buying power, all the investable power that exists has to go somewhere,” he said by phone.

With rates at rock-bottom levels, investors have been forced to seek out higher-yielding opportunities, such as cryptocurrency as it has the potential to post outsized gains.Even on bad days, junk bond investors get single-digit returns, said Tawil. “He’s going to have to put money into something ‘riskier,’ but more importantly, into something that will give him the satisfaction he’s accustomed to.”

So what happens when financial conditions become tighter? “The initial move is the opposite of what happened when they put the money in — everything’s going to go and swing the other way, until it settles down,” Tawil said. It’s because everyone knows the money is leaving the riskier stuff that’s why you see this immediate reaction in the market.”

What Caused The Crypto Market Drop And What Comes Next?

The last time the U.S. central bank raised rates was in December 2018, its final increase in a series of hikes. Bitcoin was trading around $3,700 then, and concepts such as “decentralized finance” and “non-fungible tokens” had not yet been mainstreamed. Throughout the year, the original cryptocurrency had a rough time, particularly toward the end, when Bitcoin lost over 40% during the last two months – a period when U.S. stocks also tanked.

That dynamic is playing out again now, with Bitcoin falling in step with richly-valued equities ahead of an expected new round of Fed tightening, says Peter Boockvar, chief investment officer at Bleakley Advisory Group and editor of The Boock Report.

“For now, it’s proving to be just a risk-on/risk-off asset,” he said. “I expect it to trade with other risk assets in response to Fed tightening.” Boockvar compared the digital coin to Cathie Wood’s ARK Innovation ETF, which is seen as “the ultimate risk asset” and which has also proven highly sensitive to Fed tightening as investors start to pay more attention to valuations.

Bitcoin, though, remains a supreme shape-shifter. It has represented many things to many people for more than a decade now and its (often contradictory) narratives will continue to evolve. After all, it’s been written off time and again as dead, denounced as rat’s poison, and castigated as a bubble only to come back stronger each time.

And as institutional adoption increases, Bitcoin’s future may also become clearer, says Max Gokhman, chief investment officer at AlphaTrAI, which is working on an application of its artificial-intelligence algorithms for the digital-asset space.

“We shouldn’t discount that in the future Bitcoin use cases may evolve to where it reinvents itself and gains importance anew,” he said.

Via this site.